Best Credit Card for Indian Armed Forces!

Historically, accessing credit and financial services has been difficult for military personnel. They primarily relied on cash or debit cards, often facing limitations in terms of credit access and financial flexibility whenever they need home loan or education loan for their kids.

However, over the past decade, the usage of credit cards among Indian armed forces personnel has seen significant growth. This can be attributed to increased financial literacy, the convenience of cashless transactions, and the exclusive benefits offered by banks to armed forces members.

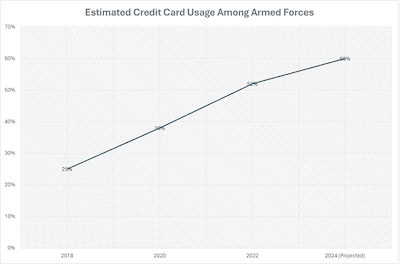

Refer this data which clearly shows the increase in usage of credit card amongst armed forces.

This increase in usgae of credit card be attributed to two key factors:

- Tailored Credit Card Products: Banks have recognized the unique needs of the armed forces and have introduced specialized credit cards with benefits like:

- Lower interest rates: To accommodate varying income levels and deployment situations.

- Fee waivers: For annual fees, late fees, or foreign transaction fees, recognizing the financial constraints and travel requirements of military life.

- Reward programs: Geared towards travel, fuel, or military-specific retailers.

- Insurance coverage: Travel insurance, accident insurance, or even coverage for lost or stolen cards during deployment.

- Digital Banking: The rise of online banking and mobile apps has made it easier for military personnel to manage their finances on the go, regardless of their location.

So how should you decide which credit card is best for you?

Key Features to Consider When Choosing a Credit Card

- Annual Percentage Rate (APR): Look for a card with a low APR to minimize interest charges on your outstanding balance.

- Fees: Prioritize cards with no or low annual fees, late payment fees, and foreign transaction fees.

- Rewards: Choose a card that offers rewards that align with your spending habits and lifestyle. Travel rewards, cashback, or discounts at military-friendly retailers can be particularly beneficial.

- Insurance Benefits: Credit cards with travel or accident insurance can provide valuable peace of mind, especially during deployments or when traveling on leave.

- Customer Service: Ensure the bank offers reliable customer service that is easily accessible even when you're stationed in remote locations or deployed overseas.

- Banking Partner: If you already have an existing relationship with any bank, you can choose the credit card from that bank and enjoy easy payment of dues and better credit limit.

Then which is the best credit card for armed forces? Here is the list of credit card and you can choose from -

Jai Hind!

Related Articles

Finance

Finance

Finance

Finance

Finance

Finance